Go on a flash crash safari with RYBN

Today, Monday 24 August, people in suits around the globe are running around, arms flailing wildly in the air. ‘Panic grips the market‘ following the announcement that the Chinese market suffered its worst day in 8 years.

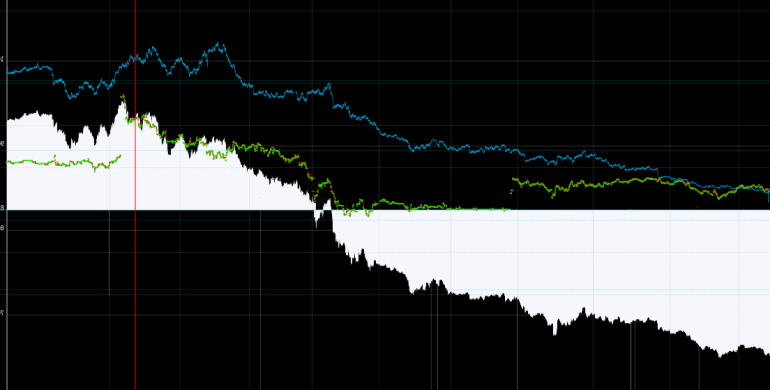

Can’t quite wrap your head around all that economy-speak? Don’t worry, the reasons for some of these sudden plummets remain a mystery even to those well-versed in the stock market. Meanwhile, leading economists like Nouriel Roubini (who correctly predicted the 2008 financial crisis) point towards ‘the rise of lightning-fast computer trading‘ as one of the contributing problems to looming and current financial crises.

So how does that tie into Algorithmic Wildlife? Enter RYBN.

At Coded Matter(s) #10: Algorithmic Wildlife, this artistic research collective will present The Algorithmic Trading Freak Show: a collection of uncommon, shocking and scandalous specimens of speculative trading algorithms. Like the freak shows of old circuses showed us the outer limits of the human species, RYBN will present to you the weird extremities of trading algorithms that silently but undeniably influence our financial markets. Like a collection of rare pinned butterflies or specimens conserved in formaldehyde for the sake of both empirical study and human curiosity, the collection presents experiments from early 1970’s to actual weapons of High Frequency Trading.

With this artist talk, we hope to provide you insight into that world of dark finance, as well as give you some visual and conceptual guidelines for thinking about algorithms. After RYBN’s presentation, An Mertens and Sjef van Gaalen will take you further, wider and deeper. More about them soon.

Meanwhile, tickets for this edition seem to be going a lot faster than usual. Please get your tickets in time to ensure you can join us on 10 September.